Before the pandemic hit, John made a decent living mowing people’s yards and doing landscaping in Houston. He had a place to live with his 15-year-old son. He even had health insurance that he bought for himself and his son “in case anything happens,” he said.

Then Covid-19 swept across the country. Nobody wanted “somebody they don’t really know on their property, in their house,” said John, who wanted to use only his first name. His work dried up. He had to send his son to live with his deceased wife’s cousin in Dallas. He ended up evicted and homeless; he slept for a few weeks on a bench near his house and then for a week under a bridge. And he had to let his insurance coverage lapse because he could no longer pay for it.

John is now sleeping on the floor in a family friend’s house. He’s found work selling pipes and rebar, but it doesn’t pay much, just $50 a day. He can hardly afford to keep his phone activated, and it’s the one way he can communicate with his son. “Sometimes I just got to pay my bill and not eat,” he said.

He can’t afford health insurance on his current income, but he needs medical attention. When he recently saw a doctor, he had sky-high blood pressure, which he attributes to all the stress he’s been through. “One doctor told me I should be dead,” he said. Without insurance, he hasn’t been able to get the medication he was prescribed; instead he’s been taking old blood pressure meds, but he’s running out. He doesn’t know what he’ll do when they’re gone.

He also got heatstroke twice in one week and had to be taken to the hospital in an ambulance. That visit nearly set him back $17,000—about $2,000 for the ambulance ride and $15,000 for the hospital stay—until he got a mailing from the hospital saying that because he doesn’t have insurance, the charges had been waived. After those experiences, he’s worried about what it would mean to get Covid while uninsured. But he tries not to think about it. “If I worry about it, I’m going to be stressing myself out,” he said.

John is one of 659,000 Texans who lost their health insurance in the first three months of the pandemic, adding to an uninsured rate that was the highest in the country before Covid-19. “It was already pretty dismal,” said Shao-Chee Sim, the vice president for research and evaluation at the Episcopal Health Foundation in Texas. As the economy slowed, millions of people have lost work, income, and with that, their health insurance. The state’s uninsured rate has climbed from 17.7 percent in 2018 to 29 percent today. Texas is one of only 12 states still refusing to expand Medicaid under the Affordable Care Act. That means only pregnant Texans, low-income people with disabilities, or parents making 17 percent of the federal poverty line for a family of three, or less than $3,700 a year, qualify for the public health program. Childless adults without disabilities can’t enroll at all and have few other options.

Popular

"swipe left below to view more authors"Swipe →

Before the pandemic, over half of uninsured Texans had no place they regularly went to for preventative medical care, compared with just one-quarter of the insured. Now the uninsured face forgoing care during a public health crisis. “Having health coverage is even more important than ever,” Sim said. “People are delaying seeking care…. If they have a serious illness, whether it’s Covid or not, it will be a major hit.”

This is the first recession the country has faced with the ACA in place. And in the states that have established private health insurance exchanges and expanded Medicaid coverage, the crisis of losing a job has not necessarily precipitated the crisis of losing health insurance. But in the states that did not expand Medicaid, there is a gaping hole in the patchwork of health coverage, and as people face widespread job loss, unprecedented numbers of them are tumbling into it.

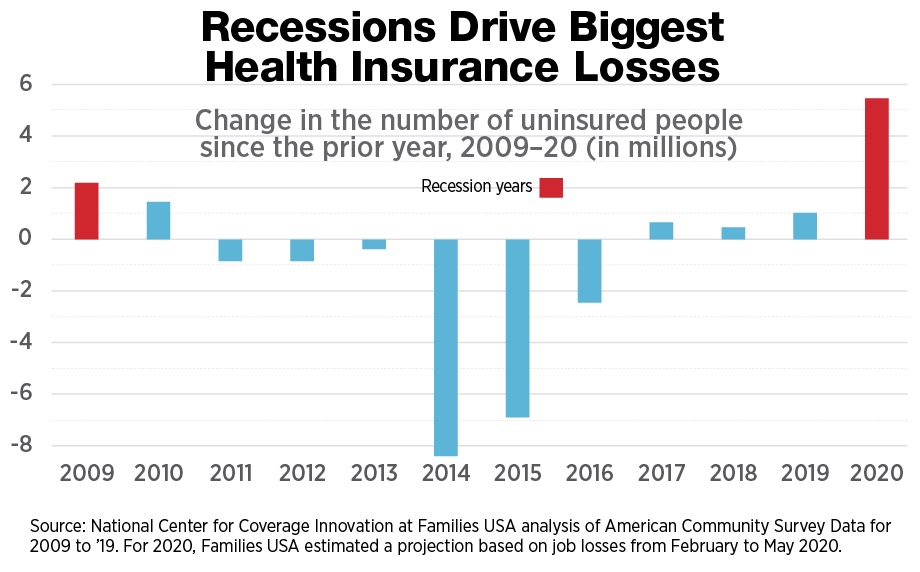

Between February and May, 5.4 million people who lost their job in the United States also lost their health insurance coverage—the highest increase ever recorded. Losses have been heavy in many nonexpansion states like Texas, the Carolinas, Georgia, and Florida. Elsewhere, Medicaid is cushioning the blow. In states where data is available, Medicaid enrollment grew 8.4 percent between February and July, and the increase was even greater in expansion states, where it was up 12.7 percent. “Absent that additional Medicaid coverage, many of those people would instead be uninsured,” said Matt Broaddus, a senior research analyst at the Center on Budget and Policy Priorities. In Medicaid expansion states, on average, less than a quarter of unemployed workers became uninsured. By contrast, in states that haven’t expanded Medicaid, on average more than 40 percent of workers who lost a job also lost insurance. Jesse Cross-Call, another senior policy analyst at the CBPP, said, “Folks who are unemployed are much more tethered to health coverage in expansion states than in nonexpansion states.” If all those states expanded Medicaid, nearly 4.3 million more adults would stand to get covered by next year.

“There’s always been pretty striking disparities…between expansion and nonexpansion states,” Cross-Call said. “Those trends are just really being put in even starker contrast now.”

For those who can afford it, coverage obtained on the ACA private insurance marketplaces is stepping in to catch them. Enrollment in the plans available on the marketplace has surged in many states that created special enrollment periods during the pandemic. But those plans are often too costly for lower-income people. An individual won’t be eligible for the subsidies that can make marketplace insurance affordable if that person’s income falls below the poverty line. Even the jobless people who were kept financially afloat by enhanced unemployment insurance benefits could fall into this category, as benefits are not counted for income eligibility purposes.

Many former employees can extend their health coverage, typically for up to 18 months, through COBRA. But it’s very expensive. On average, people using COBRA spent $7,000 on the insurance in 2019, or nearly $21,000 for a family.

That leaves Medicaid as the last option. But it’s open to only a very narrow slice of the population in states that haven’t expanded eligibility under the ACA. Parents above a certain income level—from as high as $20,417 a year in Tennessee to as low as $3,693 in Texas—aren’t eligible. Childless people without disabilities are shut out. People who can’t enroll “are likely to go uninsured,” said Eliot Fishman, a senior director of health policy at Families USA.

That’s problematic at any time. Medicaid expansion has been found to save tens of thousands of lives. “People who are uninsured typically face a lot of cost barriers in getting access to care,” said Robin Rudowitz, a vice president at the Kaiser Family Foundation, “and also tend to delay or postpone needed care because they know that out-of-pocket costs will be high.” But this difficulty in visiting a doctor could be catastrophic for public health during a pandemic. “If they have symptoms or even if they want to get tested without symptoms, they are going to be reluctant to get that taken care of because they can’t afford it,” said Fishman. While the testing is free in some places, in others it can cost up to $2,000. The federal government has allocated funding to reimburse providers that conduct tests and hospitals that care for Covid patients who don’t have insurance, but that doesn’t mean patients won’t be billed or federal funding will cover all hospital fees for patients. Some who need extensive Covid treatment may wind up with serious debt. “It is always a financial risk for a person without health insurance to have a significant amount of health care utilization,” Fishman said.

Without insurance, people with chronic conditions like high blood pressure, asthma, and diabetes may have struggled to afford medication to keep those under control before the pandemic. If they get Covid, they are at greater risk of more serious complications.

Then there are the lingering effects of Covid-19 and the possible need for ongoing care. Uninsured people may not be able to fill prescriptions for things like inhalers to help them cope with continuing symptoms.

Expanding Medicaid has been found to reduce medical bills and debt. Those without insurance in the midst of a recession and pandemic may run into a big financial toll.

“You can imagine somebody who contracts the virus and starts to show symptoms but doesn’t want to see a doctor because they’re worried about the cost,” Cross-Call said. “They’re hoping the condition gets better on its own, but when it doesn’t, their health is even more compromised.”

There is early evidence that people are simply avoiding care. In Houston, where nearly a fifth of residents lacked health insurance before the pandemic and where many more now face that prospect, there has been a huge spike in the number of people dying at home without going to the hospital or calling 911. Public health advocates worry this means that people with Covid who lack insurance are waiting until it is too late to seek help, out of fear of incurring the costs.

Worse, the people most at risk of falling into the coverage gap between Medicaid and the marketplace are some of those whose health is most at risk right now. About 30 percent of low-income essential workers were uninsured in states that hadn’t expanded Medicaid in 2018, versus 17 percent in expansion states. An estimated 650,000 essential or frontline workers would gain coverage if the remaining states expanded Medicaid. It has also been an important source of coverage for other people who are at high risk of catching Covid or developing serious complications, such as those with low incomes, heart disease, asthma, or diabetes. In Texas, 61 percent of the uninsured are Hispanic, and an additional 10 percent are Black.

“In nonexpansion states it’s a very unfortunate and infuriating situation,” Fishman said. “It’s just madness for us as a country…that people are afraid to use basic health care services in the middle of a historic health crisis because we’re the one advanced country that doesn’t cover everybody as a matter of basic public service.”

The bright side is that the number of states that have dug in against expansion is slowly dwindling and that the pandemic and ensuing recession are increasing public support for Medicaid expansion.

For the past few years, Carly Putnam, the policy director at the Oklahoma Policy Institute, has kept on the bulletin board above her desk a cartoon of someone pushing a boulder up a hill. That’s how it’s felt trying to get her state to expand Medicaid. Then she watched as organizers put the issue on the ballot in four states—Maine, Idaho, Utah, and Nebraska—and won in every one. “If Nebraskans could do it, so could we,” she thought.

She was right. On June 30 state voters narrowly passed a measure to expand Medicaid, the first state to do so since the pandemic began. “Oklahomans finally got the chance to make the choice that their legislature had abdicated,” she said. “It’s really gratifying to see Oklahoma finally meaningfully stepping up to take care of its own.” She doesn’t know exactly how the pandemic affected the vote, but she said that people who voted using absentee ballots—who were perhaps more concerned about the coronavirus and their health—overwhelmingly favored it, three to one.

“Passing Medicaid expansion in Oklahoma, which is one of the reddest states in the country, is a pretty strong signal that there is still a public appetite for expanding health coverage,” Cross-Call said.

Just a month later, voters in Missouri secured the same victory. Advocates launched the campaign to expand Medicaid in the state on the day of the Supreme Court’s 2012 decision upholding the constitutionality of the ACA but striking down the mandate to expand Medicaid. On a day when the temperature was over 100 degrees, Jen Bersdale, the executive director of Missouri Health Care for All, assembled a group to react, no matter the outcome of that case. “We got to celebrate the fact that the ACA had been upheld, but we had a new fight on our hands,” she said. After waging an unsuccessful legislative campaign to expand Medicaid over a number of years, advocates there, too, took inspiration from other states and decided to put the issue on the ballot. “It is a stain on the reputation of all of the elected officials that have not only failed to listen to their constituents but also failed to do what they needed them to do so they could get the care that they need,” she said.

The coverage gap in Missouri should be called a chasm, Bersdale argued. Marketplace insurance has become nearly unattainable for residents without subsidies. “A full-price plan [costs] more than their annual income,” she said. Now far more are falling into the void. “We have so many people now who had really secure jobs…with good health insurance and master’s degrees and 20-year careers who are suddenly out of work,” she said.

Now her fight is over. Support for Amendment 2, expanding Medicaid coverage, was even stronger in Missouri than in Oklahoma. The amendment passed with 53 percent of the vote. Bersdale saw the result coming. She had 600 face masks made with “Yes on 2” printed on them; they sold out so fast, she had to order 300 more.

She hopes the Missouri group’s success can have a ripple effect in other states that haven’t expanded Medicaid. “I would love for it to provide some hope to people in states who are still fighting,” she said.

It’s not clear yet what impact the pandemic will have on the remaining nonexpansion states. In a May poll, the Kaiser Family Foundation found that two-thirds of adults living in nonexpansion states wanted their state to expand Medicaid. The share rises sharply among those who have experienced job or income loss because of Covid—nearly three-quarters support expansion. “I do think it will make a difference. How can it not?” Fishman said. “Millions of people losing job-based health insurance, knowing that in other states they could have coverage.”

“It would be very surprising if the pandemic didn’t have an effect,” agreed Philip Rocco, an assistant professor of political science at Marquette University in Milwaukee. Congress left a space for states to fill, he said, by not taking action to extend health coverage during the pandemic. There are “a lot of people whose needs are not being addressed by, really, another government entity. It might create a little bit of added pressure.” Oklahoma may have been a squeaker—the measure passed with just 50.5 percent of the vote—but the vote occurred earlier in the pandemic, when the numbers of uninsured people hadn’t swelled as much as they have. Missouri showed momentum may be building.

There is also evidence that the expansion itself and the resulting coverage can spur people to become more active in politics; without that effect, those who could benefit may not yet be political participants. Before Covid, there was substantial support among Texas residents for expansion. But, Sim noted, “it’s one thing to express a view; it’s another who [people] vote for.”

There are only a handful of states left where bringing expansion to voters directly via the ballot is an option, and even there, it’s an uphill battle. Florida’s rules for ballot initiatives, for example, are onerous, and it’s an expensive state in which to run a campaign. In other states, expansion can happen only with legislative action. “The question is whether people are activated at the individual voter level around the issue in a way that is going to scare state legislators,” Fishman said. Time will tell, and it may take more time now that the pandemic has wreaked havoc on state legislative calendars. Kansas, for example, was on the verge of expansion when it suspended its legislative session in mid-March and then held just a one-day session in May that didn’t deal with the issue.

The pandemic could push things either way. On the one hand, voters are getting a glimpse of just what it means to have millions of people fall through such a giant tear in the safety net. On the other, opponents of expansion often argue that states can’t afford it, even though the federal government pays nearly all of the costs and states are likely to face other costs from having such a large uninsured population. The fiscal argument may hold emotional sway now that state budgets are under serious strain, thanks to lower tax revenues and a higher demand for assistance.

What is clear is that if states decided to expand Medicaid, they could get residents insured fairly quickly. Some states have rolled out expansion in a matter of months or even weeks. They can also make coverage retroactive, helping people cover bills they already incurred to get Covid testing and treatment.

“These are really extraordinary times,” Cross-Call said. “The need to connect people with health coverage is critically important right now.”

Of course, getting enrolled in health insurance may not be top of mind when someone loses employment during a pandemic of historic proportions. For many, filing for unemployment benefits was likely the first priority, a process that in many states was incredibly complicated and drawn out. So while the number of people enrolling in health coverage under the ACA has gone up, “that uptick is not commensurate with the number of people who have lost employer coverage,” Fishman said. “There are still significant numbers of people falling through the cracks.” He said that if Democratic nominee Joe Biden wins the presidency, “there starts to be a conversation about more automatic enrollment mechanisms. Just making coverage available and trying to make it very easy for people to sign up…can only get you so far.”

There are other ways that a Biden presidency could narrow the Medicaid coverage gap. While he hasn’t backed Medicare for All, the plan championed by Senator Bernie Sanders that would put everyone on public health insurance, Biden has proposed creating a Medicare-like public option available for purchase in expansion and nonexpansion states alike, with premium costs subsidized through tax credits and capped at a percentage of income. He would also ensure that subsidies were available to make marketplace coverage more affordable for those who qualify.

John is still trying to put all the pieces of his life back together. He recently called a construction company he used to work for that offers health insurance and pays $18 to $20 an hour. It said it would gladly take him back, but he needs his own transportation to get to jobs. His license was suspended a while ago over a ticket he got for lack of insurance, and now, thanks to the pandemic, there is a month-and-a-half wait just to get an appointment to get a new license. While he waits, he’s clinging to the hope that his current job will pay him more, maybe for selling concrete instead of pipes.

“I just wish this corona stuff was over with,” he said. “I’m ready to get back to a real job making real money so I can get back into my own house and get back with my son.”